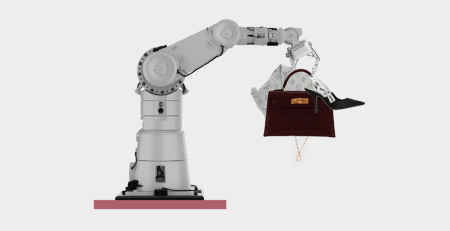

The Hermès Birkin : A Profitable Investment

You have probably asked yourself this question at least once: “Is a Hermès Birkin better than an investment in gold “? the answer is a big Yes.

How the Birkin bag story started

How the Birkin bag story started

According to Fashion lore, Birkin’s birth is an exciting story. It all started from a happy accident. It was born out of an exchange between Birkin and former Hermès chief executive Jean-Louis Dumas on an Air France flight from Paris to London in the early ’80s.

What makes the Birkin so unique?

Hermès bags are crafted in France using premium and popular materials such as Box calf, Alligator, Clemence, Epsom, Togo, and Ostrich leather.

Each bag is made entirely by hand. Then, Birkins are very functional. They have multiple pockets and other useful secure options available.

A few things to know :

– The Value of the Birkin increased over 500 % in the last 35 years,

– Birkins bags are only sold to notable clients of Hermès,

– Better investment than the stock market historically,

– Much less supply than demand fuels price growth,

– The “Himalaya Niloticus Crocodile Diamond Birkin 30” has been estimated à 380.000 dollars

Here are three tips to help you maintain your luxury goods :

First, store your bag properly: a designer bag always comes up with a dustbag, so make sure to pop it inside after any use.

Secondly, be careful about what it comes into contact with.

Your bag is valuable and delicate, and you should be mindful of where you place it. Please avoid the floor and any dirty or sticky surfaces at any cost.

And finally, use bags within bags.

If you carry makeup with you, it would be more judicious to place your makeup tools and item in a bag before placing them inside your Birkin. It will avoid any unwanted stains and protect the lining of your bag.

The incredible price

The Hermès Birkin is considered the most expensive bag in the world. Its value is estimated between $12,000 and $200,000. Therefore, only a small amount of people can afford it, and even if you can afford it, it is not certain you will be able to acquire it. Indeed, Hermès does not sell in-house. If you want to possess this incredible piece, you would have to join a waiting list that can last up to six years, depending on the model you want. Those walls push people to get their hands on the Birkin on the secondhand market, where prices are way more out of reach.

The value of the prestigious luxury bag has never fallen since it was launched on the market.

According to Quartz : “An investor who bought an ounce of gold in 1980 and sold it in 2017 would have earned an average of 2.1% per year. If he had bet on the S&P500 over the same period, he would have earned 5.3%. But if he had bought a Birkin bag and sold it last year, his average annual return would have been 14.3%!”

Its continuous and regular surge is explained by the meager number of specimens on the market. Each Birkin is, in fact, handmade from A to Z by the same designer. And a few limited editions in the line further increase the accessory’s rarity, and thus the increase in its value.

Investments such as gold or the stock market have fallen sometimes violently. Birkins haven’t.

Hence it is definitely worth investing in a Birkin over the long term.